The Closing Process

Making a Closing a Pleasant Experience

Spring is right around the corner, which means it is home buying time! New real estate agents come into the market frequently with dreams of working just a few hours a week while earning $100K a year. We all know that’s unrealistic. It takes years to build up a client base, and clients only come back when they had a great experience the first time around.

Delayed closings and extended wait times can really change how a client feels about their experience. Origin Title & Escrow doesn’t waste people’s time because we don’t overbook closings. Our attorneys have the title information on hand at closing and can easily answer any questions that should arise.

Buyers always remember the day they got the keys to their new home, ensure it’s a pleasant experience by using Origin Title & Escrow.

Importance of a Buyer’s Closing Attorney

Buying a home is, perhaps, the largest and most significant investment of your life. It also involves a unique set of property laws that can raise unexpected issues at closing. That’s why a buyer usually selects the attorney to handle the transaction.

We have a client who is an investor that fixes up and sells old homes. He didn’t quite trust the seller’s closing attorney, so he brought Origin Title on to review the title. As it turned out, the seller only got a deed from one heir while there were two more individuals with an interest in the property. Even with title insurance, cleaning up the title would take valuable time and lower the value of the investment. It’s not always about title insurance, but about seeing the potential problems before buying a property.

A buyer’s attorney serves to make sure the buyer’s interests are protected. The buyer normally choses the closing attorney, especially in a cash-purchase where the closing attorney represents the buyer. It is important for cash-purchasers and investors to have an attorney look at title and closing documents on their behalf before closing, even when the seller insists on using their closing attorney. Origin Title and Escrow can help avoid drawn-out and expensive title issues for their clients.

A Quick and Stress-free Closing

Some attorneys start doing real estate closings because it looks easy and can be profitable. At a closing, the attorney simply explains documents for the buyer and seller to sign, and often, it looks like they are just pointing to a signature line. But what if there is a title issue? The ‘point and sign’ attorney may not be much help.

Origin Title and Escrow reviews the title and takes steps to fix about one-third of all files closed. The fixes can be something as simple as creating a joint tenancy when the owners were not sure how they owned the property. Or it can be a mess like when a Condominium Association has been dissolved and no one is paying dues because there is no entity to collect. Origin Title and Escrow takes the time to research the issue and come up with a resolution. In the case above, we would send an estoppel letter to the condominium association’s last address listed with the Secretary of State to estop the condo association (if it’s ever re-formed) from trying to collect past dues on the unit. They have five days to respond or lose their lien rights.

Advise your real estate agent to use Origin Title as their closing attorney so everyone involved can get to the closing table quickly and without stress.

Legal Property Descriptions

If you saw that a property is being purchased in the “21st District, 2nd Section of Cherokee county, starting at an apple tree, thence to a pine tree to line of Eli Wilbur, thence back to the road, up to a hickory tree, thence west 50 yards, thence south 80 yards, thence to E.G. Casey land, being 21 acres more or less” — would you have any idea which property was being referred to? This is from a real deed from 1945!

Legal descriptions like these were written assuming everyone already knew what was being sold. This clearly doesn’t hold up 70 years later, though.

Additionally, street addresses are not sufficient to describe real estate. Several years ago, many addresses changed due to requirements from the new 911 system. Addresses are not permanent, and that is why it’s not sufficient to simply list an address on a deed.

This also rings true for tax parcel numbers. Years ago, DeKalb County had letters in their parcel numbers for properties that were in DeKalb County, but in the city of Atlanta. DeKalb County has since changed this to make the numbers uniform throughout the county.

Realtors benefit from working with closing attorneys who both understand the implications of an insufficient legal description and know how to recognize and correct them.

Have Refi? Will Travel.

Everyone has heard of the real estate transaction that blows up at the closing table. The reasons vary widely, but in our office about 95% of all purchase transactions close. With purchases, both the buyer and the seller are typically very motivated to see the sale through, so problems that arise are taken care of, so the deal can go through.

Refinances don’t have that high a close rate – in our office refinances close about 90% of the time. This might be surprising, since a refinance only happens when the homeowner initiates it, but little problems that arise on the way to closing can derail a refinance. The homeowner may decide keeping the current loan is less trouble than dealing with the requirements for the refinance.

A refinance is much easier for the homeowner if the closing attorney will go to them for closing. Origin Title is happy to travel to homeowners in Metro Atlanta. Homeowners who are thinking of refinancing should seek out a closing attorney who will come to them.

Who holds the earnest money in a For-Sale-By-Owner transaction?

When a buyer enters into an agreement to purchase a home, the sales contract specifies the amount of earnest money paid and who will hold said earnest money. Should the seller be the person designated to hold the earnest money?

It is more prudent to have a real estate agent or closing attorney hold the earnest money, so that the buyer won’t have to fight to recover it if the contract falls through. If the seller holds the earnest money and decides to keep it, no matter the terms of the contract, the buyer may spend more than the earnest money trying to recover it.

Buyers considering a for-sale-by-owner property should choose an experienced closing attorney to draft or review the sales contract and hold the earnest money until the sale is complete.

Remember the movie Brazil?

The rogue handyman, Harry Tuttle, played by Robert DeNiro, didn’t follow the rules because he hated the paperwork. The paperwork found him on the street one day and he eventually disappeared in the mass of papers. People selling their house without an agent can feel as if they are being buried by paperwork, but the biggest risk is overlooking necessary paperwork. Every situation is a little different, but Origin Title provides a basic checklist for sellers to make sure they have everything in order and don’t delay the closing.

No matter which side of the For-Sale-by-Owner transaction an individual is on, having a qualified real estate attorney oversee the process will stop closing-day horror stories.

FSBO Checklist for sellers in the Atlanta metro area:

- Check to see how you have title to the house

- Make sure all water fixtures are low-flow. Or see if there is an exemption that applies.

- Complete the Lead paint disclosure if the house was built before 1978.

- Seller’s disclosure to indicate what appliances and fixtures are remaining with the property.

- Check to see if your house is in a flood zone (flood maps do change)

- Check the zoning map to make sure nothing has changed (zoning can also change)

- Locate your Owner’s Title Insurance Policy from when you purchase the house (if you have one).

When there’s no real estate agent, how does a buyer begin the buying process?

Once the buyer has decided on the house of their dreams, they need to make an offer to the seller. An offer is simply a sales contract signed by the buyer and sent to the seller. The contract will give the seller a set number of days to respond by agreeing to the contract, or making a counter offer.

Origin Title does not negotiate the terms of the sale, but we can prepare the sales contract for the offer to make sure the contract matches the intent of the parties. In early May, I closed a ‘for sale by owner’ purchase where the sales contract stated that all the costs were to be paid by the buyer. The seller wired an extra $1,000 because he said HE was supposed to pay the closing costs. It’s rare that a buyer and seller both want to pay closing costs, but a properly prepared sales contract would have prevented this confusion.

The modern buyer who conducts business on their mobile phone may feel constrained by the paperwork required for home purchase, but the value and clarity of a written contract is worth it. A qualified real estate attorney can make sure the buyer’s interests and intent are preserved.

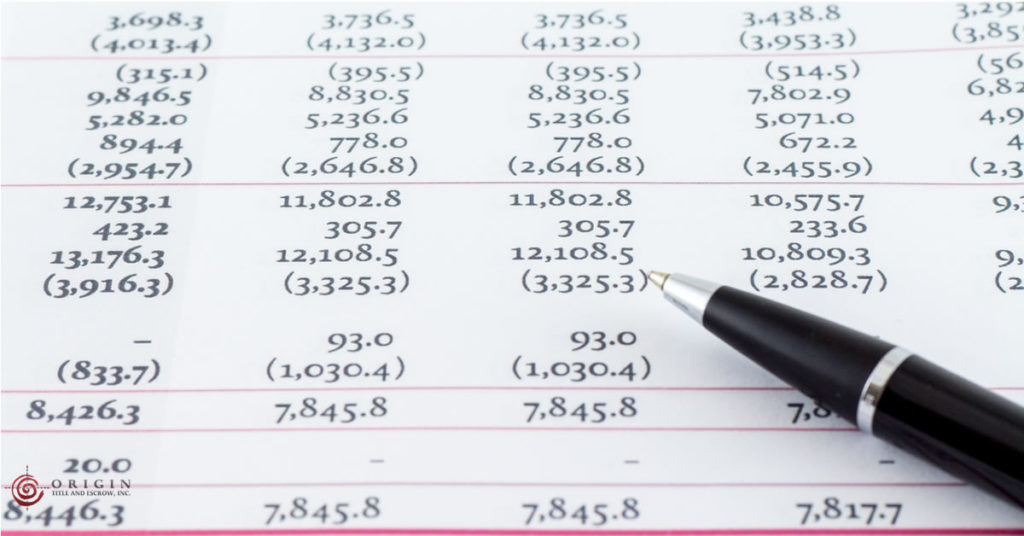

WHAT IS AN IOLTA ACCOUNT?

Real estate attorneys have a separate IOLTA escrow account to receive and disburse all funds involved with a real estate closing.

IOLTA stands for Interest on Lawyers Trust Account and it means that the money in that account does not belong to the attorney. Interest earned on the account also does not belong to the attorney. The interest earned, minus bank fees, goes to fund legal aid programs in the state of Georgia. The Tax ID number on the account is the Georgia Bar Association’s, not Origin Title’s. I account for every penny in the account for each file on a daily basis.

With wire fraud cases and check forgery on the rise, real estate agents want to know a real estate closing attorney who has stringent safeguards in place to protect the funds held in escrow for closing.

GEORGIA DEPARTMENT OF REVENUE LIENS

In 2017, the Georgia legislature passed a law changing how we searched liens filed by the Georgia Department of Revenue. The law initially required a ‘clearance letter’ from the Georgia Department of Revenue before any deed could be filed. Thankfully this was repealed and replaced in 2018. The GSCCCA is an on-line statewide searchable database for lien and deed records. The new law (HB661) that was recently signed into law includes the following changes:

- State Tax Liens (“DOR liens”) have a ten year duration and DOR liens may not be renewed.

- DOR liens filed prior to 1/1/2018 became invalid on 1/1/2018.

- DOR liens are not state-wide liens. Before a DOR lien can attach to real property, an execution must be filed with the clerk of the county where the land is located.

- DOR liens are filed with the county clerk by electronic transmission to the GSCCCA. The GSCCCA must then further electronically transmit the lien to the county clerk.

- The DOR lien is deemed to be filed and perfected upon its receipt by the GSCCCA.

- When the DOR files a lien it must also provide that information for inclusion in the pending lien database maintained by the GSCCCA.

- A DOR lien does not attach to the interest of a subsequent bona fide purchaser or lender whose deed or security deed is recorded before the tax lien has been filed.